Is a recession coming? What does that mean for the NZ housing market?

I thought it would be good to dig into NZ history and look at some of the past NZ recessions and more importantly what the housing market did and when did it bounce back? What will this mean for you if you are buying or selling in the next 12 months?

Firstly, NZ is not technically in recession right now - but this could quite likely change!

What is a recession? Essentially it is a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters.

New Zealand has had 9 recessions and some of the major ones are listed below.

The Depression (1930–1934) At this time, New Zealand’s exports were highly concentrated. The Depression was an international event. House prices were kept low.

The Wool Bust (1967–1969) The undiversified nature of the export sector may not have been important in the Depression, but it certainly was in the Wool Bust. In 1965/66, around 31 percent of New Zealand’s exports were wool.

The First Oil Price Shock (1974 –1977) Real annual house price inflation reached 30 percent in June 1974. From 1970 to 1974, real house prices rose by approximately 62 percent. But between December 1973 and January 1974 oil rose from USD4.31 per barrel to USD10.11 per barrel. In addition, actual oil exports were physically restricted – we saw property prices fall.

The Second Oil Price Shock (1979–1982) - Real house prices were still falling despite low or even negative real mortgage interest rates. Then oil prices more than doubled following the Iranian revolution and the start of the Iran-Iraq war, both of which materially disrupted the supply of oil. Unemployment rose quite rapidly, from 1.3 percent in December 1979 to a then-unprecedented level of 4.9 percent it took to June 1983 for a recovery in the housing market.

The 1991–1992 Recession - Following years after the 1987 share market crash our GDP growth had been subdued (at best) but took a further sharp step down in 1991. Confidence fell away sharply, as did real activity in both the business and household sectors. House prices fell, with real prices declining by 4.7 percent over 1991. These falls occurred even though interest rates were falling throughout 1991.

The Asian Crisis and drought (1997–1999) - The Asian financial crisis, beginning in July 1997, saw several important Asian economies forced to float their exchange rates, which then fell very sharply, leading to serious losses within the corporate and banking sectors, and some very large falls in GDP. Around one third of New Zealand’s exports were destined for Asia – and much of Australia’s trade was also with Asia. New Zealand economy faced two successive severe droughts too in 1997/98 and 1998/99. Housing takes off again post-recession.

Global Financial Crisis (2007-2009) Major investment bank Lehman Brothers which was one of many banks having sub-prime mortgage-backed securities, it filed for bankruptcy on September 15, 2008. It triggers a series of events causing a severe economic downturn in 2008-2009, commonly known as the Global Financial Crisis (GFC), New Zealand's GDP contracted for six quarters in a row. Lower housing prices were an outcome in NZ.

Source: Reserve Bank of New Zealand: Bulletin, Vol. 71, No. 2, June 2008

All of these recessions have different causes as to why they started. However, most (not all) recessions normally start in NZ because of global factors. Essentially what happens globally normally has a major bearing on our small economy.

So today we find ourselves in a position which feels not too dissimilar to possible recessions of the past. The latest issues are largely global driven, the ensuring global inflationary pressures, and the Ukraine conflict is certainly flowing negative sentiment through the NZ economy. It is also exacerbated by our current governments decision making and quantitative easing (money printing) during the pandemic.

So, let’s consider that NZ possibly drops into the technical recession territory, what will that do? How long could we see a property contraction happening? Actually, the contraction is well underway now, but how far could it go in a recession?

Wouldn’t we all love a crystal ball here! Looking at data above and reading many pieces of literature, New Zealand’s nine post-Second World War recessions, had an average annualised contraction in real GDP of 3.8 per cent, followed by steadily increasing real GDP growth over the next two years, from 3.0 per cent during quarters 1 and 2 up to 5.5 per cent during quarters 7 and 8.

So, in layman’s terms there is a relationship between duration of recession and the recovery time to the previous peak. My take home is ‘the shorter the recession, the shorter the recovery time to previous peak, and vice versa’.

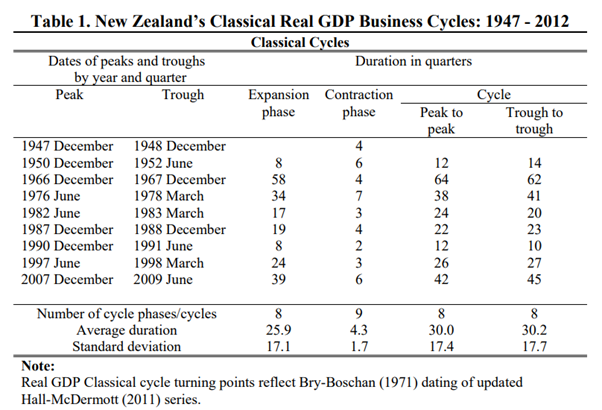

I believe this table from the Reserve Bank of NZ is really telling in which the contraction periods are on average 4.3 quarters (approx. one year) and the following expansion duration being on average 25.9 quarters (approx. 6.5 years). Therefore, showing sharp contractions followed by longer periods of approx. 6-7 years to get back to peak. But extremely similar length of time from peaks to peaks of activity and trough to troughs of approx. 30 quarters (or 7.5 years) showing indeed these cycles are quite cyclical in nature. Therefore, where we are experiencing now is not at all unusual.

Let’s try and make sense of all this for you….

We are not quite in recession yet but we are starting to behave like we are already. If we do fall into recession in the next quarter or two, I would suggest we will start to see heightened negative consumer sentiment and housing prices will continue to fall for the whole of next year, 2023. By 2024 we should start to see housing prices correcting. We have already seen a reduction in housing prices and lower levels of sales activity. But my best analysis of this is you will continue to see a further lowering of house prices.

So, what should you do?

If I was considering selling my property at some stage in 2023, I would do it now, and no later than the first quarter of 2023. Any later in the year, and I would suggest that you could quite possibly be selling into a technical recession. If I was a seller (vendor), I would take a good offer when they come along and not be too greedy about it. Recessions tend to bring higher levels of unemployment, which can affect first home buyers and families purchasing properties so they may take a step back too. Next year also is a general election. This historically points to slower activity especially in the months leading up to the general election and subsequent months post-election. Therefore, if you are thinking of selling, my advice is to get your property on the market soon.

If you are considering purchasing a property and are not really affected by higher interest rates, anytime from now through to early 2024 then the next year represents a good buying opportunity. A record level of building consents have already been processed and because of the recent pandemic there is a lower level of NZ population growth due to essentially no immigration. I therefore believe there will be better choice of properties coming available that might meet your needs.

The data above does indicate if you are buying you will reap the rewards in the housing market for the next 6-7 years especially post a recessionary period. So, buying now and throughout 2023 then holding and being very patient will be a fantastic place to be and a sound strategy.

My last tip is don’t be too cute, don’t try and pick the absolute trough as its unlikely you will get this right. My gut feeling is that if you can, it will be a good time to buy in the next 12 months. If the house ticks the boxes, then it’s probably a good buy and go for it! I am hoping this may help you when trying to figure out whether to sell, or buy in the future.

All the best.

Kind regards,

Tyson